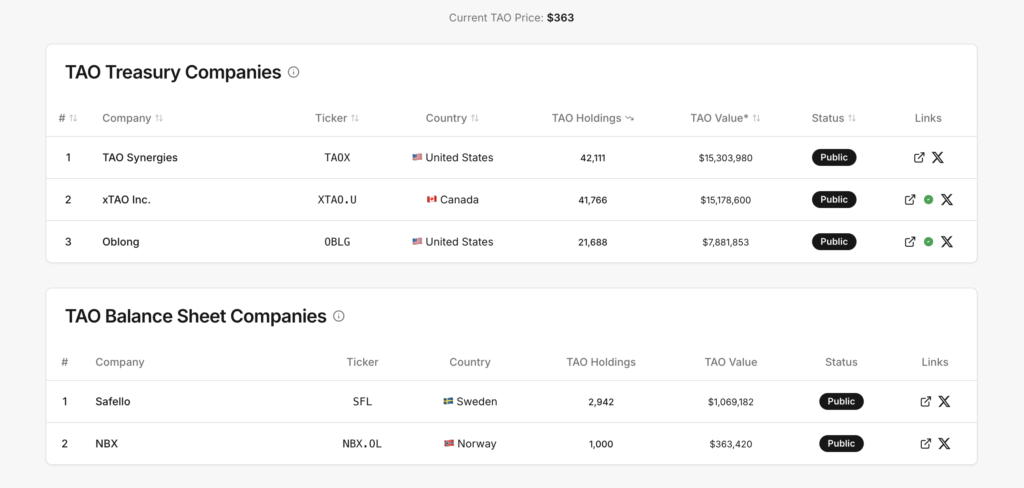

The adoption of $TAO continues to move beyond miners, validators and delegators—public companies and institutions are now beginning to hold the asset on their balance sheets. While disclosure is still in its early stages, several listed entities have confirmed $TAO positions through official filings and public statements.

📊 Who Holds TAO?

- (TAOX, 🇺🇸) TAO Synergies – 42,111 $TAO

Claimed via SEC filings and PR announcements. - (OBLG, 🇺🇸) Oblong Inc. – 21,688 $TAO staked

Reported through earnings releases alongside cash disclosures. - (XTAO.U, 🇨🇦) xTAO – 41,766 $TAO held

Confirmed in public press reports. - (SFL, 🇸🇪) Safello – 2,942 $TAO

Declared in a company statement. - Tensor Suisse (🇨🇭) – Undisclosed holdings

Private equity vehicle developing regulated $TAO vault strategies to provide institutional exposure. - (NBX.OL, 🇳🇴) NBX – 1,000 $TAO

Norway’s NBX became the first public company to announce purchases of alpha tokens alongside $TAO, also offering custody as a service to hedge funds.

🔍 Why This Matters

- Institutional adoption validates $TAO as a treasury-grade digital asset.

- Proof-of-reserve frameworks are still needed to strengthen trust.

- The presence of both listed companies and private equity players signals that institutional strategies for $TAO are already forming.

If you need more real-time information on public companies holding TAO as treasury assets, TAO Treasuries website is a great place to stay updated.

Be the first to comment