By: @CryptoZPunisher

Introduction

The Forex (Foreign Exchange), the largest financial market in the world, with $7.5 trillion traded every day, remains dominated by centralized (Web2) platforms with opaque fees, concentrated liquidity, and limited accessibility. In the crypto space, we’ve seen DEXs and derivatives platforms flourish, but they are still focused on digital assets. The Forex market remains largely underexploited in Web3.

This is precisely where 0xMarkets comes in: a multi-asset perpetual DEX (currencies, commodities, crypto, and eventually other Real World Assets) powered by the Cartha subnet (SN35) on Bittensor.

By combining Web3 decentralization, Bittensor’s dynamic incentives, and an architecture inspired by the best DeFi protocols (Curve, Uniswap, Aave), 0xMarkets aims to revolutionize global currency trading.

Why Forex instead of just crypto?

- Forex represents $130 trillion in annual volume, 19× the daily trading volume of crypto.

- Derivatives (CFDs, futures) dominate this market but remain centralized and heavily regulated.

- Crypto = $394 billion/day, Forex = $7.5 trillion/day.

👉 The ambition of 0xMarkets: capture part of this colossal volume with a permissionless, transparent, incentive-driven alternative.

The limits of centralized Forex (Web2)

- Regulatory barriers: exclusion of many regions (20–30% of the market “handcuffed”).

- Counterparty risk: brokers act as the “bank against the trader,” creating conflicts of interest.

- Restricted accessibility: minimum deposits, geographic restrictions, leverage caps (e.g., in Europe).

- Little Web3 innovation: no competitive decentralized equivalent to giants like Plus500 or ZFX.

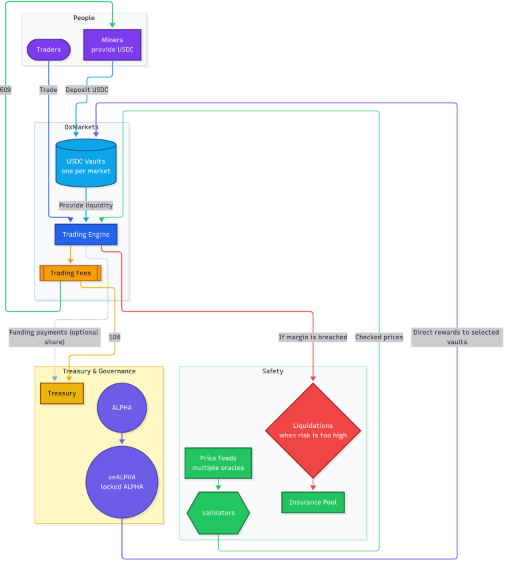

Cartha SN35: Liquidity-as-a-Service Engine

The role of the Cartha subnet is to provide the programmatic liquidity powering 0xMarkets.

- Miners act as Liquidity Providers (LPs) by depositing USDC into vaults dedicated to specific markets (e.g., EUR/USD, GBP/JPY).

- These deposits fuel the perpetual contracts (perps) traded on the DEX.

- The longer liquidity is committed, the more Alpha tokens miners earn, the utility and governance token of 0xMarkets.

- Validators monitor prices via oracles, execute liquidations, and secure the overall system.

👉 Alpha can then be staked as veALPHA, granting governance rights and a share of fees.

Opportunities for traders

- Global access: no geographic restrictions or minimum deposits.

- Leverage up to 500x: a rarity even in Web2.

- Familiar Web2 experience (CFD trading) but with Web3 benefits (permissionless, transparent).

- Fewer hidden fees: algorithmic, visible spreads unlike traditional brokers.

- Deep liquidity: ensured by Bittensor incentives and LP competition.

Opportunities for miners (LPs)

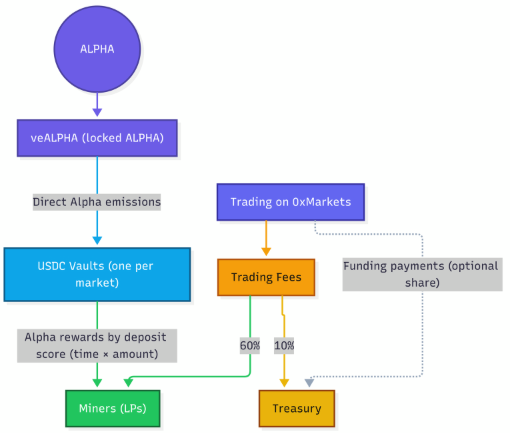

- Dual rewards: 60% of trading fees. Alpha emissions proportional to the “deposit score” (amount × duration).

- Dynamic allocation: rewards adjust according to market demand.

- Long-term incentives: locking Alpha as veALPHA increases voting power and revenue share.

👉 Unlike Web2 brokers who only profit from spreads, here LPs are fully integrated into the protocol’s economy.

Litepaper: technical details

The Litepaper highlights several key points:

Roles of participants

- Miners (LPs): deposit USDC, select specific vaults, and earn 60% of fees + Alpha emissions.

- Traders: trade perps with up to 500x leverage, permissionlessly.

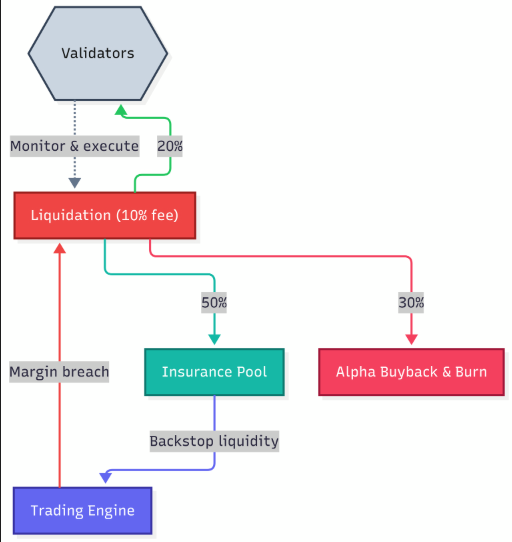

- Validators: verify multi-oracle price feeds, monitor markets, execute liquidations, and earn 20% of liquidation fees.

Fee & incentive mechanics

Trading fees:

- 60% → miners

- 10% → treasury

- Liquidations (10% fee): 20% → validators 50% → insurance pool 30% → Alpha buyback & burn

- Alpha emissions: distributed based on deposit score (amount × time).

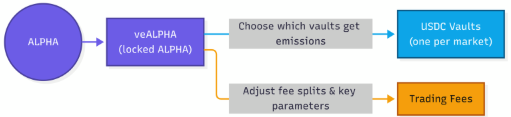

Governance (veALPHA)

- A true Curve-like model: Vote on which vaults receive emissions. Adjust fee splits and protocol parameters.

- The longer Alpha is locked, the greater the voting power and fee share.

Security

- Multiple oracles with cross-checking.

- Automatic liquidations once margins are insufficient.

- Insurance pool funded by liquidation fees to cover “black swan” events.

Risks and responsibilities

The Litepaper also stresses the risks:

- For traders: Leverage up to 500x can lead to total collateral loss. Market volatility (FX, commodities, crypto, RWAs).

- For miners: High collateral required ($200k–1M). Locked by epochs → no instant withdrawals.

- For validators: Heavy operational responsibility (slashing on failure).

- System risks: Smart contract vulnerabilities. Dependence on Cartha subnet and Bittensor.

👉 0xMarkets is a high-yield but high-risk protocol, suitable only for participants able to handle such volatility.

About the players

- Taoshi (founded in 2023): a Web3 company developing DeFi subnets on Bittensor.

- @taoshiio @0xarrash

- General TAO Ventures (GTV): blockchain x AI fund, linked to Contango Digital, bringing top DeAI teams to Bittensor.

- @mikecontango @ContangoDigital

- Victor Teixeira (GTV): described by Arrash Yassavolian (CEO of Taoshi) as “probably the best subnet economy designer in Bittensor.”

- @gtaoventures Victor M. Teixeira, LinkedIn

ELI5: 0xMarkets explained simply

Imagine you want to trade Monopoly money for allowance cash, but until now you had to go through a banker who set the rules, took a big cut, and could change prices to their advantage.

0xMarkets removes the banker:

- Those with money (miners) put it into a shared pool.

- Those who want to bet on currencies (traders) use the pool to play, under clear, visible rules.

- Referees (validators) make sure everyone follows the rules, otherwise they hand out red cards (liquidations).

- Everyone is rewarded in tokens (Alpha), and those who keep them long-term get to decide the future rules.

Useful links

- Website: 0xMarkets.io

- X account: @0x_Markets

- Documentation: docs.0xmarkets.io

- GitHub: coming soon

Enjoyed it? A like and a share are the best ways to support my work. Thank you!

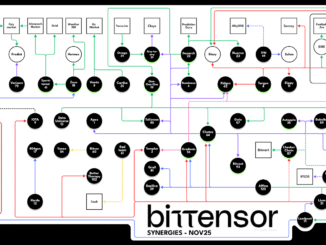

🗺️ All links are listed on Magellan, the unique mind map of the network:

https://xmind.ai/share/aDEFBhk7?xid=VMLmgtuz

💜 Support my work. If you enjoy my content and appreciate Magellan, you can support my work:

💸 Donation address: 5DnZ7Evyund7fPcBzntyVoNgzULTdyhscYCSzJA569131aGR

Be the first to comment